Oxford X Model Portfolio User Manual

Hello. I’m Todd Skousen, CEO and Executive Publisher of The Oxford Club. I wanted to take this opportunity to walk you through our Oxford X model portfolio.

We designed this portfolio because we know how busy you are. We know you don’t always have time to read about and act on the many recommendations produced every week in all of our VIP Trading Research Services.

So we decided to take the best 10 picks from these services and put them in a single portfolio, overseen directly by Oxford Club Research Director Kristin Orman. We then created a new page on the Oxford Club website where Chairman’s Circle Members can easily access these top trades. We also have a strategy to communicate any changes in the portfolio – and explain the logic behind those changes – as soon as they occur.

Perfect for the busy investor, Oxford X will simplify your financial life and help you crush the S&P 500 Index.

Kristin Orman

Kristin Orman is the Research Director at The Oxford Club. She provides deep, fundamental and inferential insight to the Club’s strategists. The Club’s secret to success, according to Kristin, is its ability to marry Wall Street financial analysis with Main Street common sense. We like to think that her discovery of the system behind Oxford X is the perfect example.

Super-Metrics

Before we get to how to use Oxford X, let’s talk briefly about how these 10 stocks make it to this elite level, as that’s the key to this portfolio. We want you to know exactly what you’re getting and why.

To create Oxford X, Kristin combed through 5,500 trades we’ve recommended at the Club over the past 22 years, looking for the best performers and what characteristics, if any, our financial strategists shared. This labor-intensive process uncovered five distinct characteristics – we’re calling them “super-metrics” – that these top performers had in common.

After isolating the five super-metrics, Kristin oversaw the creation of a sophisticated ranking system that scans hundreds of open Oxford Club recommendations from all of our research services.

Here are the five super-metrics so you can see what Kristin is scanning for…

Metric No. 1: A low market cap. Smaller companies and their stocks have greater potential for rapid growth.

Metric No. 2: A low debt-to-equity ratio. This weeds out companies with even a minimal chance of finding themselves in financial distress.

Metric No. 3: A “Goldilocks” relative strength index, or RSI. Companies with an RSI between 30 and 70 are in the “Goldilocks zone” – neither overbought nor oversold. The average RSI of our biggest winners has been 54.

Metric No. 4: A beta of more than 1.4. Beta is a measure of a stock’s volatility in relation to the broader market. Our winners’ average beta is 1.42, an indication that they can move more than – and beat – the market.

Metric No. 5: A low share price. Our 10 biggest all-time winners had an average share price of around $20, giving them a lot of room for huge upside moves.

As our research team performs this scan, each recommendation gets a score based on how well it matches the five super-metrics. The 10 recommendations with the highest scores make it into this elite Oxford X portfolio. And when the top 10 in the ranking change, the Oxford X portfolio will change too, and you’ll be notified that afternoon.

Communications

Here’s the best part about Oxford X: To use it, you need only keep the lines of communication open. That means reading your Chairman’s Circle emails, which will be labeled to let you know the content is about the Oxford X portfolio. There are three types of emails you can expect to receive about Oxford X.

Portfolio alerts: If one of our analysts issues a sell alert on a stock in the Oxford X portfolio, it will be removed from the portfolio. You will receive an alert around 3 p.m. ET with a summary of any stocks that were dropped from the portfolio that day.

Weekly updates: Each Friday, in The Chairman’s Circle Weekly Briefing, you’ll get an update on the Oxford X model portfolio. And if any positions were dropped from the Oxford X portfolio that week because of a sell alert, we’ll use the Weekly Briefing to swap in new recommendations based on Kristin’s scans.

Monthly Oxford X portfolio review: Usually on the first Friday of each month, Kristin will provide updates on positions, detail any changes or additions, and dive deeper into the research behind why certain plays are especially primed for massive growth.

In the event that an Oxford X stock gets outranked by a new stock recommendation (which can come from any of The Oxford Club’s VIP Trading Research Services), you’ll be alerted in Kristin’s report with all the details. You’ll learn why a particular stock was removed from the Oxford X portfolio… and why a new stock earned a position within the top 10. This will include the stock’s ticker symbol and an explanation of why the stock is poised to outperform.

But a word of caution: Just because a stock is dropped from the Oxford X model portfolio doesn’t necessarily mean it’s a “Sell.” It may remain an excellent stock for you to hold; it’s merely fallen out of our top 10. Similarly, the fact that a stock is added to the Oxford X model portfolio doesn’t make it a new “Buy” recommendation. Again, the Oxford X model portfolio is simply a ranking of the top recommendations at the Club based on Kristin’s proprietary system. So if you already own a stock that makes it into the Oxford X model portfolio, we’re not necessarily recommending you buy more shares. Members should refer back to the original service in which the position was recommended for the most accurate recommendations, dates and prices.

Please note that, due to liquidity, recommendations will undergo further scrutiny before being added to the Oxford X model portfolio.

The Oxford X direct line: You’ll get direct phone access to our team of REAL PEOPLE… available to answer any questions you have about your subscription. This team of Oxford X specialists is available at 844.294.4696 or 443.708.9411 from Monday through Friday between 8 a.m. and 8 p.m. ET.

The Oxford X Website

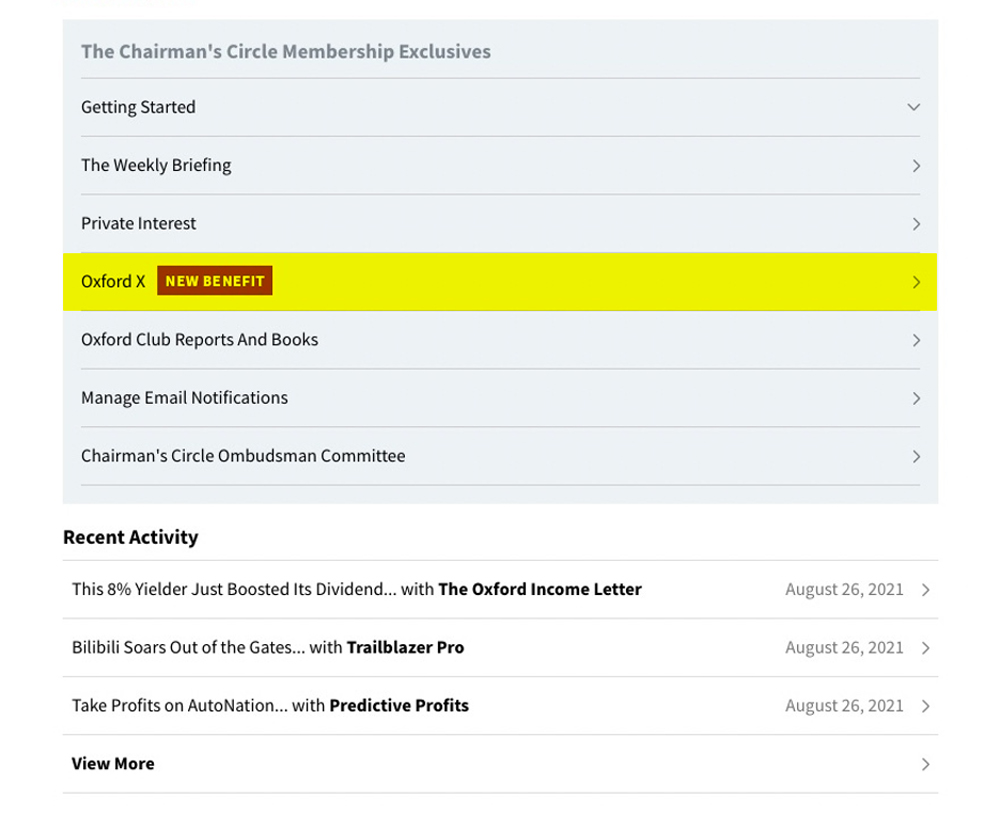

We’ve also created an Oxford X page on our website where you can easily access the Oxford X portfolio. There, we will archive everything mentioned above. It’s your one-stop shop to ensure you have everything you need to profit. To get to this new page, merely click on the Oxford X link on your Oxford Club homepage, as you can see below.

While Oxford X will certainly simplify your financial life, we still encourage you to browse our VIP Trading Research Services when you have time to see how they work and perform. This will allow you to maximize your Chairman’s Circle Membership. Remember that the 10 picks in Oxford X are drawn directly from these services.

So while Oxford X represents the best of the best, there are many other great recommendations available to you as a Chairman’s Circle Member. And you will very likely find that while some services don’t have recommendations currently in the top 10, they can still provide value to your portfolio.

The Oxford X Portfolio

Many Members wonder why we do not provide a full portfolio with Oxford X. That is, a portfolio that includes an entry date and the current gain or loss based on when we added the recommendation to the Oxford X rankings.

We completely understand why Members would want this, especially Members who track only Oxford X trades.

But keep in mind that Oxford X is not a standalone trading service. It is a ranking system that compiles recommendations from existing trading services. We scan all of our VIP Trading Research Services for recommendations that match as many super-metrics as possible. Oxford X then provides the top 10 recommendations based on those scans.

As we said earlier, when we add a stock to Oxford X, that does not make it a new “Buy” recommendation. Similarly, a stock dropped from Oxford X isn’t necessarily a “Sell.”

With that in mind, we can’t provide new entry dates and entry prices based on when these positions were added to Oxford X. That would undermine our strategists’ original recommendations. Plus, having two sets of entry prices and dates for a single recommendation could be confusing.

Now, you’ll notice that sometimes we tout the gains that positions have seen since joining the Oxford X rankings. After all, it’s exciting to see when the super-metric system is working. But the officially tracked entry prices and dates will always come from the trading services. So we ask that you always refer to the originating trading service for details on a particular recommendation. That’s why we always include links to the strategists’ alerts.

Another thing you might see is that by the time a recommendation is added to the Oxford X rankings, the position might already be enjoying some solid momentum.

That’s another reason to always refer to the original entry date and price before making a decision to buy.

Check out the strategist’s write-up from the time of entry, then decide for yourself whether you still want to jump in.

As one Member told us, “I now use Oxford X as my first-pass filter. Then [I] go on to understand the alerts that interest me. I would recommend this service to anybody who values their time.”

Options Guide

Finally, if you’re new to options, we recommend reviewing our “Options Quick Start Guide.” The guide is detailed (as trading options is a bit more complex than trading stocks), but it’s also clear, straightforward and easy to follow. Since we’ll typically include an options play alongside our top 10 stock recommendations, I suggest you look over this guide to familiarize yourself with this often lucrative way of trading in case you decide to act on one of our options plays.

I hope you enjoy this new benefit of The Oxford Club Chairman’s Circle. I sincerely hope you’ll take the time to explore Oxford X and the many other Chairman’s Circle benefits.

My team and I spent quite a bit of time arranging these services and benefits to bring your subscription to life. And we couldn’t be more excited that we are a part of your journey to a prosperous future.

If you have any questions, feel free to call our Oxford X direct line at 844.294.4696 or 443.708.9411.