Bright Future Ahead for U.S. Hemp Market

Here in the U.S., the biggest topic in cannabis is the cannabidiol (CBD) market.

And with countless uses for CBD in such a wide range of retail markets, it’s not hard to understand why.

You can find CBD in almost everything – from hygiene products, like lip balms and shampoos, to infused beverages, like tea and beer.

And for investors the growth potential of this “profit trend” is massive, whether you’re looking at conservative or aggressive growth estimates.

For example, New Frontier Data’s Hemp Business Journal expects the U.S. CBD market to grow to $1.3 billion by 2022.

Yet the Brightfield Group – a cannabis industry research firm – says the U.S. hemp-derived CBD market could reach a staggering $22 billion by 2022.

In either case, we can expect major growth in this market. But an important question remains…

Just as we saw last year with the broader cannabis market… and just as we’ve seen in every other market that experienced fast-paced growth…

Could the CBD market be getting a bit overheated?

Emerging Trends Strategist Matthew Carr discussed this very topic in his weekly video series, CannaBiz Now!

We shouldn’t be surprised to see this happening in the cannabis market.

Hype around a trend often leads to a cycle of bloated valuations followed by a much-needed market correction… even while underlying fundamentals remain promising.

We saw this pattern happen in the broader cannabis sector last year. After a couple years of high-flying stock gains and widespread media hype, cannabis stocks suffered a huge correction, leading into a wider correction in the stock market.

But even as market valuations were crumbling, the industry’s future was actually getting much brighter.

We watched Canada legalize recreational cannabis nationwide. Canadian cannabis suppliers witnessed a surge in newfound sales and earnings.

And here in the U.S., the passage of the 2018 Farm Bill unleashed the industrial power of hemp production – especially in the form of hemp-derived CBD products.

So it’s possible that market valuations could, once again, fly off the handle as the media grabs hold of the momentum behind CBD.

But should investors be scared?

Not at all.

It means people must become prudent in how they identify profitable opportunities in this market – looking for the most reliable and promising companies to invest in, rather than those attempting to gain short-term CBD-related attention.

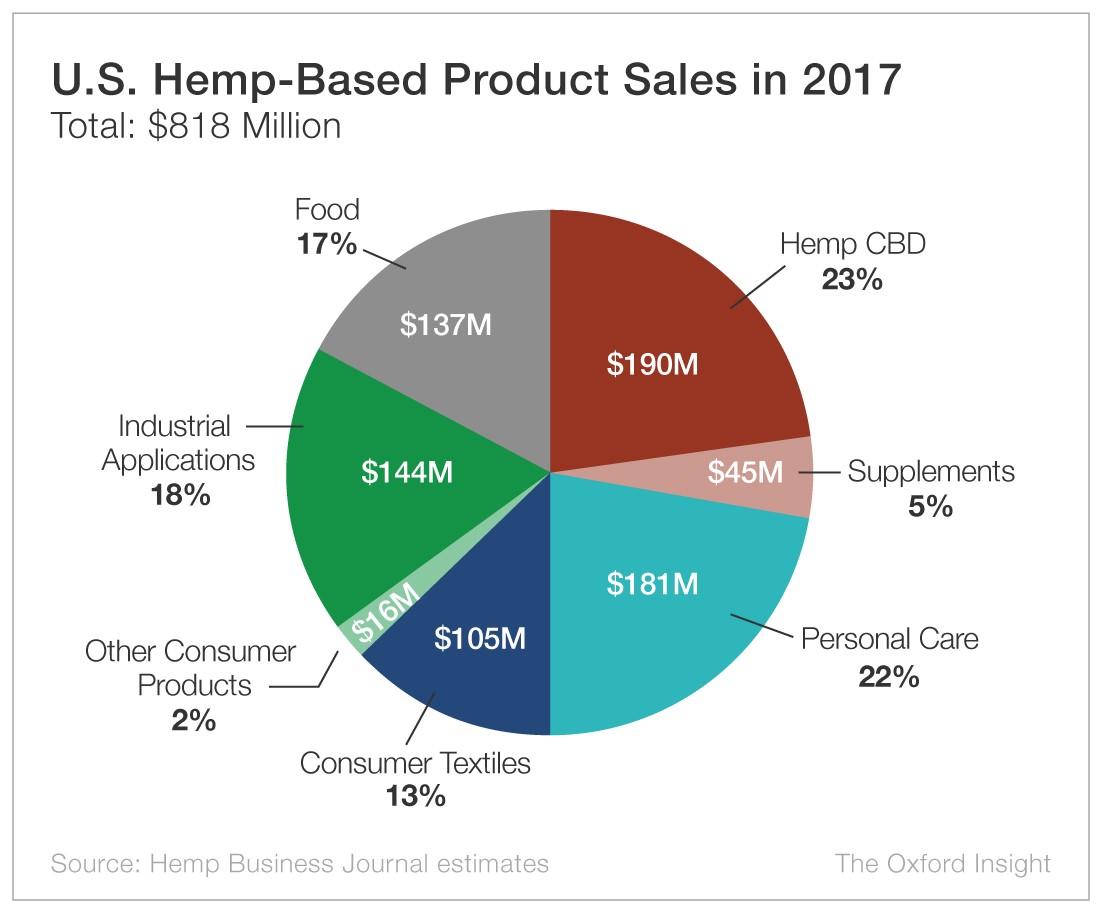

Stepping back from CBD a bit, let’s look at the broader U.S. hemp market.

Beyond CBD, hemp has a wide range of use cases and applications.

Though hemp-derived CBD is generating significant sales, non-CBD hemp products still constitute a larger slice of the pie.

Most states have now developed state-licensed industrial hemp programs to produce not only hemp-derived CBD products but also fibers and textiles, paper, animal feed, and even human food using hemp.

In other words, hemp production extends far beyond topical creams. It impacts many other retail markets as well.

That’s why the profit potential for the U.S. hemp industry is so explosive – and exciting – for both entrepreneurs and investors.

And we’re bound to see this excitement translate into what I call the “hype and flight” cycle that new, innovative markets are notorious for in their early stages.

Don’t let this cycle discourage you. It’s the nature of the game.

Good investing,

Anthony