The #1 Gold Trade for 2021

Right now, we’re witnessing the biggest money-printing operation in the history of the world.

Globally, the government solution to fixing the problems caused by COVID-19 is printing TRILLIONS of dollars and dumping it into the economy and stock market.

Global debt is $277 trillion as a result of the pandemic, Reuters confirmed.

There’s no thought of slowing down.

Now, you and I know what the inevitable conclusion will be.

Inflation… and lots of it.

Unstoppable Demand Ahead

Of course, the central bankers know this too.

Which is why they are also buying and holding as much gold as they can get their hands on.

In the face of massive money printing… virtually every country on earth is now hoarding gold.

This once-in-a-lifetime event is setting up a MASSIVE supply shortage for gold… at a time when gold demand is suddenly going through the roof.

All that money printing is inevitably going to result in enormous inflation… which will add rocket fuel to gold’s run.

Merrill Lynch and its analysts say the price of gold will hit $3,000. Bank of America is predicting $5,000. Some forecasts are as high as $10,000 per ounce.

Keep in mind that gold is currently selling for less than $1,900 per ounce. So these price estimates are calling for a minimum increase of 50% to nearly 500%.

Gold-related stocks often have returns that are multiples of gold’s move.

There’s little doubt in my mind that we are headed for a massive gold bull market in the months ahead.

That’s great news for DRDGOLD (NYSE: DRD).

The Tale of Tailings

DRDGOLD is a South African gold producer and a world leader in the recovery of gold and precious metals from the retreatment of surface tailings.

The company has two tailings facilities in South Africa – the Ergo Mining Operations and Far West Gold Recoveries.

Tailings are the material left over after processing ore to recover the contained metals. The tailings have traditionally been dumped or piled near the mining site.

Much of the 150-year mining process in South Africa has focused on extracting the highest-grade gold and ore.

The leftover material – the tailings – contains lower-grade gold and other precious metals.

In past decades, it wasn’t economically feasible to extract the remaining minerals from these tailings…

But now, with precious metal prices soaring and the cost of finding and developing a new mine escalating… the huge stockpiles of tailings are being revisited.

Advances in technology in the tailings process, combined with rapidly increasing gold and precious metal prices, have made the tailings business not just feasible… but highly profitable!

And DRDGOLD is sitting in the catbird seat in the tailings industry…

The company has created a process called “nano-extraction” that allows it to run tailings through its “retreatment plants” and extract huge amounts of gold and other precious metals.

It has the facilities and technology improvements to fine-grind gold-bearing tailings to achieve highly profitable recovery.

The level of efficiency DRDGOLD has achieved is well beyond the capabilities of typical mining processes.

In addition, increasing commodity prices across the board have made it feasible to extract not only the remaining gold in these tailings, but also uranium, nickel, copper and other metals.

That’s why this play is different from any gold trade you’ve likely made before…

ALL of the gold is ALREADY out of the ground.

But the future recently got dramatically brighter for this tailings processor…

You see… in a move that got little attention… DRDGOLD recently vaulted to world leader status.

Neither Wall Street nor Main Street has caught up with what just happened.

That gives you a terrific opportunity…

The Merger That Changed Everything

In July 2018, the company announced a transformational merger with fellow South African-based precious metals mining company Sibanye–Stillwater (NYSE: SBSW).

Sibanye-Stillwater is the world’s largest primary producer of platinum, second-largest primary producer of palladium and third-largest producer of gold.

DRDGOLD acquired the gold assets of Sibanye-Stillwater’s West Rand Tailings Retreatment Project – now known as Far West Gold Recoveries – in return for a 38.1% stake in DRDGOLD.

On January 10, 2020, DRDGOLD announced that the two companies further solidified their partnership. Sibanye-Stillwater exercised an option to acquire an additional 12% in DRDGOLD for approximately 1 billion rand.

This merger turned DRDGOLD from an important player in the tailings industry to potentially an industry-dominating juggernaut.

The Far West acquisition increased DRDGOLD’s total mineral reserves by nearly 82%.

With the financial help of Sibanye and the proceeds from the January 2020 stock purchase, the company has developed, expanded and improved on its tailings facilities.

The company’s nano-extraction process is state of the art.

It took until last year to fully upgrade its facilities (the coronavirus complicated matters further), but the efforts are now paying off.

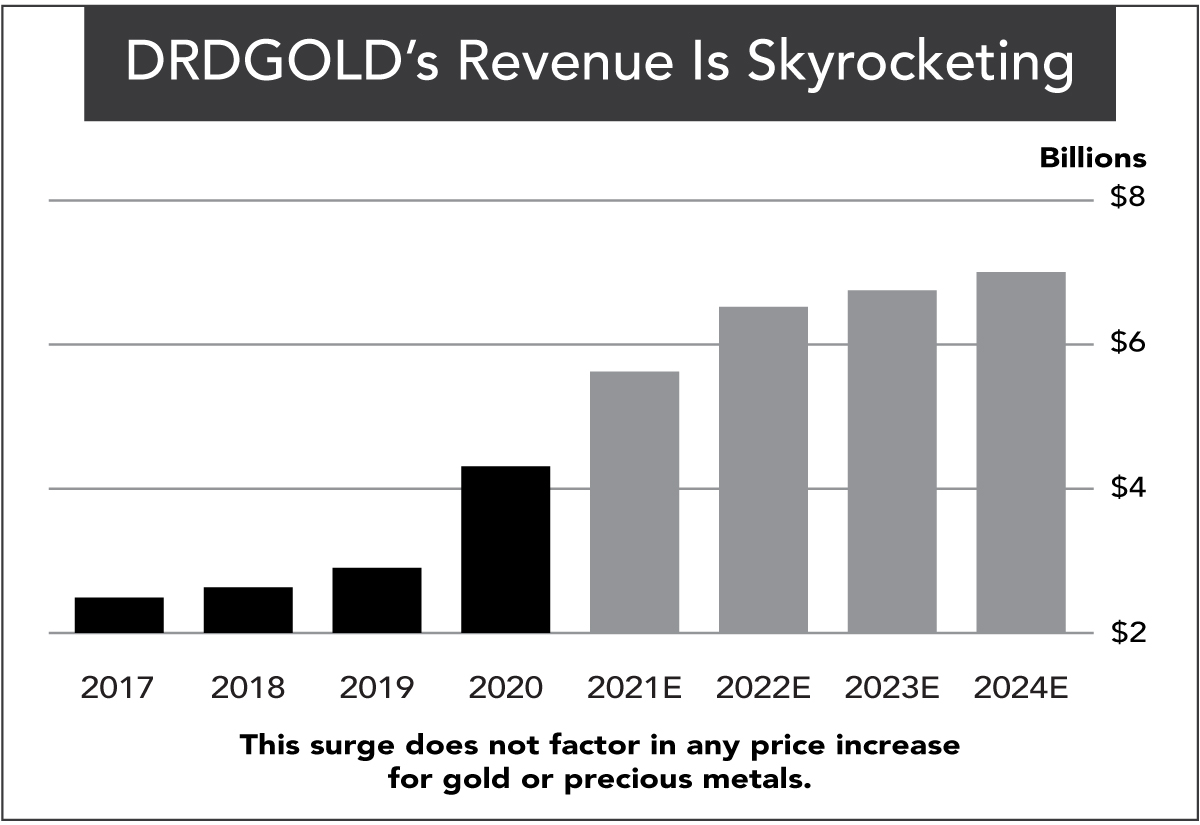

The improvement in the company’s performance is outstanding… and just getting started.

The Gold Tailings Cash Machine

Here are the highlights from the company’s 2020 fiscal year-end report compared with its 2019 annual report:

- Revenue increased by 52% to 4.1 billion rand due to higher gold production and gold sold. The average rand gold price received increased 33%.

- Operating profit increased by 320% from 371.8 million rand to 1.56 billion rand.

- The operating margin was 37.3% in 2020, compared with 13.5% in 2019.

- The company reported earnings of 634.5 million rand (82.4 rand cents per share) compared with earnings of 72.7 million rand (10.9 rand cents per share) in the previous year.

- DRDGOLD ended the financial year with cash and cash equivalents of 1.71 billion rand and no debt.

(Keep in mind that these results occurred while South Africa experienced the raging COVID-19 pandemic. In 2020, mining operations were completely shut down for more than a month and at 50% for nearly two months.)

In the most recent quarter, gold production increased 45% compared with production in the same quarter the previous year. Cash operating costs per kilogram of gold sold decreased by 10% compared with that in the same period last year.

Cash and cash equivalents increased by 300.1 million rand to 2 billion rand. Debt remained at zero.

And to top things off, DRDGOLD and Sibanye are further expanding the tailings operations at West Rand.

The beauty of DRDGOLD’s business is that surface tailing operations are substantially automated with minimal labor and fixed cost requirements.

So as gold prices rise – as I fully expect in the years ahead – DRDGOLD’s profits will skyrocket.

Here’s what could happen to the company’s fortunes…

For every 10% increase in the price of gold… this company’s revenue is expected to jump by $307 million and its operating profit is expected to go up by $133 million.

If gold goes up 20%… its profit would jump to $370 million!

If gold increased 50%… the company’s profit would multiply more than seven times over to $769 million.

And here’s the thing…

Thanks to Sibanye’s accumulated stockpile of tailings already at West Rand… the estimated gold ounces in those tailings total 10.4 million ounces.

The company’s current tailings reserves reflect an operating life of 11 years for the Ergo operation and 20 years for Far West.

And now DRDGOLD also has access to the tailings resulting from Sibanye’s huge mining operations across Africa. The merger makes DRDGOLD the landing spot for treating hundreds of millions of tons of precious metal tailings from Sibanye’s properties.

That means there’s no shortage of available gold supplies for DRDGOLD to tap into.

And here’s another thing working in the company’s favor… its gold production is not hedged. Its gold is sold at current market prices. The price of gold will be heading higher.

Last but not least, the icing on the cake… DRDGOLD pays a significant dividend. The current yield is 3.9%.

In its 2020 fiscal year, the company paid an annual dividend of 85 rand cents per share – the highest in company history and its 13th consecutive year of a dividend payment.

It’s All Coming Together

Thanks to its merger with Sibanye, DRDGOLD is now a low-risk but very high-reward way to play the resurging interest in gold and the higher prices ahead.

DRDGOLD can use Sibanye’s resources, industry expertise and financial strength to create a growing business and strong balance sheet.

This stock is not going to stay at less than $10 for very long.

There is little doubt in my mind that this will be THE premier gold stock of the coming years.

No company is better positioned to tap into above-ground gold deposits.

So if you are looking for a way to beat inflation…

To capture a massive capital gain…

And collect hefty dividend checks in the meantime, this is the company for you.

Action to Take: Buy DRDGOLD (NYSE: DRD) at market. Place a 25% trailing stop on your position.