How to Get Paid to Invest in Metals

I’m certainly bullish on gold, the historical store of value…

But gold won’t be the only metal that benefits from the global money printing taking place.

Real, tangible assets are what’s going to soar. Precious metals and industrial metals are joining the party… and heading higher.

That’s why I think owning shares of Rio Tinto (NYSE: RIO) will be a big winner in the months and years ahead.

Rio Tinto is the second-largest metals miner in the world. This company has its hand in virtually every valuable and useful mineral. It controls $81 BILLION worth of assets across the globe.

The company discovers, mines and processes mineral resources worldwide. Its vast resources include aluminum, silver, molybdenum, copper, diamonds, gold, borates, titanium dioxide, salt, iron ore and uranium.

Rio’s metals portfolio benefits from the heavy-handed money printing, which is inflating metals prices across the board.

But in addition… Rio’s production of industrial metals is seeing increased demand as the U.S. spends billions to repair its crumbling infrastructure.

For years, politicians have promised to rebuild the United States’ crumbling infrastructure. Absolutely nothing has been done. President Biden says he is going to change that and tackle the problem.

It is estimated that the U.S. needs to spend $4.5 trillion to fix its infrastructure.

And infrastructure building and repair is also a global issue…

The Global Infrastructure Outlook estimates that the world needs to spend $94 trillion on infrastructure in the next 20 years, and $28 trillion of that will come from China alone.

London-based Rio Tinto will gladly help supply the raw materials for this kind of construction activity.

The Bedrock of Rio Tinto’s Business

Rio Tinto’s bread and butter is iron ore, which makes up 56% of its revenue, and that is followed by aluminum and copper.

Meanwhile, China’s factory activity is growing at its fastest rate in a decade. It makes up half of the world’s demand for copper, and it is gobbling up other commodities – including iron.

So it’s no surprise that China is one of Rio Tinto’s largest sources of sales.

Iron ore prices skyrocketed 70% in 2020 due to Chinese demand – a remarkable statistic in a global economic slowdown.

Should world economies recover (or should an infrastructure boom occur, as I expect), we could see iron ore prices go higher still.

Bauxite is the main ore in aluminum – and Rio Tinto has the best bauxite assets and aluminum profit margins in the industry. The 147-year-old company is Canada’s largest aluminum producer.

The U.S. consumes more than six times the amount of aluminum it produces – so American customers need Rio Tinto’s aluminum.

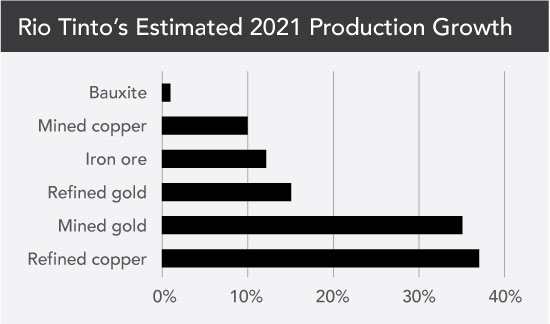

In the meantime, Rio Tinto is expected to boost production in several important metals as demand increases in what should be a coming global economic recovery.

A Metals Empire

Revenue has increased for the last five years. In 2020, Rio had $44.6 billion in revenue, 3% higher than 2019’s revenue.

Rio’s $23.9 billion in gross profit for 2020 was 13% higher than its gross profit for 2019. This follows a 17% jump in 2019.

Rio reported 2020 net earnings surged 22% to $9.8 billion… and that’s after issuing $9 billion in dividends during the year!

Cash flow is at an eight-year high. Its $15.9 billion in operating cash flow in 2020 was 6% higher than last year’s (operating cash flow soared 26% in 2019 compared with 2018’s cash flow), and its $9.4 billion of free cash flow was 3% higher than 2019’s free cash flow (following a 31% jump from 2018to 2019).

And while demand for Rio’s metals is increasing… costs are decreasing.

This brings me to what sets Rio Tinto apart from much of its competition… it’s revolutionizing the use of artificial intelligence in its mining operations.

Rio has automated machines pulling minerals out of the ground day and night… seven days a week. There are more than 80 autonomous pieces of equipment – above and below ground – in operation at company facilities.

Mining operations are transitioning from manual labor to industrial robots, autonomous mining vehicles and project management software.

Plus… this is a company that takes environmental issues seriously.

Rio does not mine coal or extract oil and gas, and 76% of its electricity consumption at its managed operations is supplied by renewable energy.

Since 2008, the company has reduced greenhouse gas emissions by 46%.

And I’m always looking for financially strong companies that pay a healthy and growing dividend. Rio Tinto meets my criteria in spades.

The company pays a dividend twice a year. The size of the dividend varies depending on earnings.

Rio Tinto plans to pay dividends that equal 40% to 60% of its earnings, plus special dividends when possible.

In 2020, the company paid an exceptionally generous dividend of $5.57 (including the special dividend), which was 72% of underlying earnings.

To ensure the company can pay as promised, management has cut debt from $13 billion in 2016 to $700 million currently.

The current planned dividend (not including any special dividends) for 2021 is $3.86 per share. That’s a yield of 4.4%.

A Company for the Long Haul

Rio has a clear growth path for years to come…

We’re at the beginning of several trends: out-of-control money printing, an infrastructure boom, rising metals prices and recovering economies.

Needed infrastructure improvements around the world will accelerate demand for metals.

On top of that, increasing scarcity and lack of easy access will push metal prices higher.

And the biggest catalyst is the result of massive money printing… Global debt hit a record $277 trillion in 2020. U.S. debt was nearly $27 trillion.

Inflation will pose a problem sooner than people think.

Having exposure to metals is an excellent way to profit from these trends.

As the demand and prices of metals increase, so should Rio Tinto’s earnings, dividends… and share price.

Holding Rio Tinto is the best way I know of to get paid to invest in a variety of metals.

Action to Take: Buy Rio Tinto (NYSE: RIO) at the market, and add it to the High Yield Portfolio. Place a 25% trailing stop. Hold the stock in a tax-deferred account if possible.